06/11/2025

0 comments

Refurbished smartphones: growth signals ahead, but trust still needs to be earned

1. Two-thirds of Europeans open to refurbished, an untapped potential

Across the four countries surveyed, consumer openness to refurbished smartphones is strikingly consistent. This “refurb-ready” audience represents a major growth lever for circular tech stakeholders.

Poland leads the way, with 66% of consumers that already own or would consider buying a refurbished smartphone, followed closely by France and the UK at 64%, and Germany slightly behind at 62%. The narrow spread between markets suggests a continent-wide readiness that goes beyond local trends, signaling a maturing perception of refurbished devices across Europe.

.jpg?width=500&height=625&name=Ipsos-dipli-2025-results-4%20(1).jpg)

💡 But intent is not yet action. Despite this high declared openness, conversion remains below potential. The challenge for tech professionals is now to bridge the gap between curiosity and purchase, turning willingness into adoption.

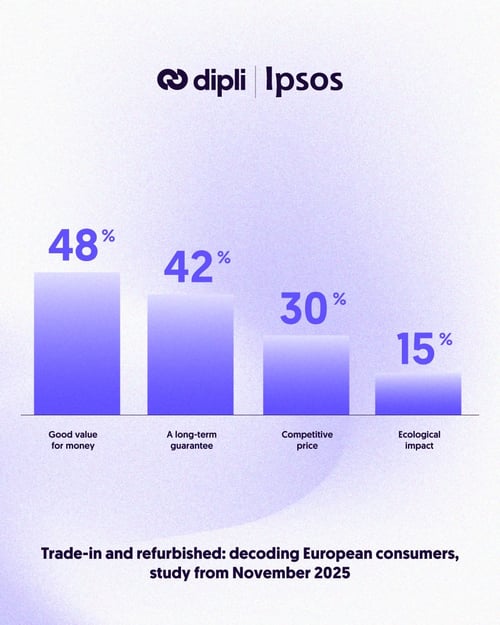

2. Price leads the purchase, sustainability remains secondary

Despite growing awareness of environmental issues, the choice to buy refurbished remains firmly rooted in economic rationale. Indeed, 48% of consumers cite “good value for money” as their primary motivation when choosing a refurbished smartphone. This is followed by a long-term guarantee (42%) and competitive pricing (30%), all indicators of a logic-driven purchase decision.

Only 15% of respondents mentioned ecological impact as a key factor, highlighting a clear hierarchy: for most buyers, refurbished means “smart” before “green”. While sustainability may reinforce the decision, it rarely initiates it.

💡 This insight is strategic for players in the circular tech space since it proves that, positioning refurbished devices as reliable, high-performance, and economically attractive, remains essential to conversion. Ecological arguments can complement the value proposition, but they cannot replace functional and financial proof points in today’s market.

3. Consumers trust needs proof from refurbished

Trust remains the key barrier holding back refurbished adoption, and consumers are clear about what earns it. The results show that proof of quality and transparency matter far more than generic claims.

A long-term guarantee (42%) and reliability equal to a new device (42%) top the list of reassurance factors. Buyers want certainty that the device will perform and last. Security guarantees (29%), and factory reset confirmation (21%) are also essential for building confidence. These elements point to a larger truth: consumers need visible, verifiable signals of trust and performance, not just branding or ecological claims.

💡 Quality control, clear warranty policies, and transparent refurbishment processes must be made explicit at every step of the buyer journey. These proof points aren’t optional: they are conversion drivers.

Smartphones trade-in: disparities across countries, but an undeniable service to scale

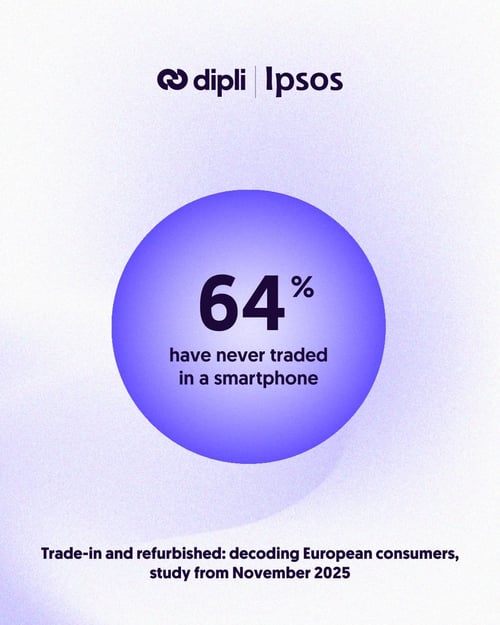

1. The trade-in reflex remains to be built

Despite growing awareness of circular solutions, smartphone trade-in is far from a mainstream habit in Europe. Through our 2025 study edition, we reveal that 64% of consumers have never traded in a smartphone: a clear signal that the reflex to resell, rather than store or discard, is still underdeveloped.

This low adoption points to persistent behavioral barriers. Many users still keep old devices “just in case”.

💡 Trade-in is not just a service, it’s a behavior to design. Shifting mindsets demands clarity, simplicity, and strong incentives to move trade-in from an exception to a reflex.

2. A good trade-in value still drives satisfaction, along with process simplicity

When it comes to trade-in, financial value remains the top priority for consumers with 59% of respondents identifying a “good trade-in price” as their primary motivation to engage in the process. The economic rationale is clear: consumers expect fair compensation for their old devices.

Beyond pricing, simplicity and immediacy play a critical role. 41% of consumers value the ability to receive an instant discount on a new device, directly linking trade-in to their next purchase decision. And for 36%, the motivation is simply to avoid letting devices sit unused, a behavioral nudge that can be activated by seamless, well-communicated trade-in programs.

💡 Together, these insights underline a strategic imperative: trade-in programs must be frictionless, financially appealing, and clearly linked to consumer benefits. The winning formula? Shorten the process, and reward the decision, fast.

3. Invest in seamless user-experiences to win consumers' trust

Trade-in adoption doesn’t just hinge on value, it hinges on experience. 72% of consumers expect the entire trade-in process to take less than 30 minutes. Speed is not a bonus, it's a baseline.

Beyond quick execution, trust is built through diagnosis led by in-store technician (38%) , which reinforces transparency and reassures users about the fairness of the valuation. Meanwhile, 36% expect fast payment, with instant bank transfers often preferred over vouchers or delayed rewards.

💡 Optimizing UX at every touchpoint is now a competitive advantage. That means designing trade-in journeys that are not only fast but also simple, guided, and trustworthy, whether in-store or online. High-quality user-experience is what defines loyalty and conversion in circular tech.

The 2025 Dipli x Ipsos study reveals a clear signal: Europe is more open than ever to refurbished devices and trade-in programs, but hesitation, trust gaps, and uneven experiences still limit adoption. Consumers are ready. Yet, converting intent into action requires removing friction, proving quality, and simplifying journeys.

For tech players, the opportunity is real, but so is the complexity. That’s why we’ve built the Dipli Circular Index (DCI): a strategic benchmark that rate circular maturity across Europe. With the DCI, tech professionals can finally measure readiness, align efforts, and scale their circular initiatives with confidence.

Dipli simplifies the second life of electronic products.

An all-in-one tool for distributors, leasing companies, telecom operators and companies to manage the entire value chain in one place.

The platform connects the electronics industry to secondary markets; simply and securely. Trade-in and return management, refurbishment, omni-channel purchasing and distribution: Dipli covers and simplifies all stages of the circular economy.

Comments (0)