MAJ : January 14, 2021

We predicted, December will mark the end of 2020 with an increase in the prices of refurbished smartphones. This second deconfinement had the same effect as the first. Demand increased as stores reopened, but supply slowed in early December, causing prices to rise. Still less brutal than in June, there is an upward trend on many models.

See you in 2021 for a new analysis of the price evolution of the reconditioned.

MAJ : 16 décembre

Phase 1: Containment

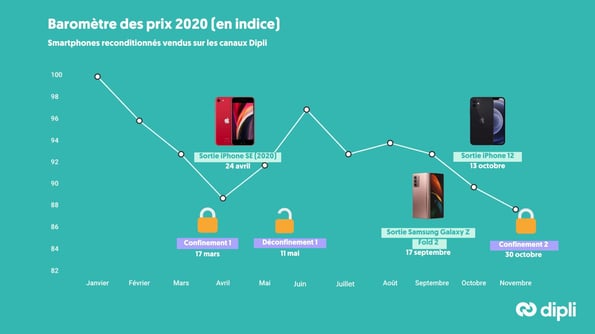

We saw a sharp drop in prices to – 10 points from March 16 to April 30, 2020. To compare with -3 points over the same period in 2019.

During the lockdown period, supply remained sluggish. This sharp drop is unprecedented in the reconditioned market, and is largely explained by the panic effect of the factories in the face of the many uncertainties about the future and the fall in demand.

At the beginning of May, a first price increase (3 points) took place with more orders from the retail sector which anticipated the reopenings of May 11 and a still reduced supply following the supply flows at the stop, especially from operators.

Phase 2: Deconfinement

The market experienced a significant catching-up effect, with a sharp increase in demand. Physical stores and online platforms have been overwhelmed by many customers wishing to renew their smartphones, whether in the field of refurbished or new.

But on the remanufactured market, supply is not extensible, supplies have remained at a low level, processing plants are still operating with short-time work and operator flows arrive on average within 1 month on the market (collection and reconditioning time necessary).

Consequences : prices have risen sharply ! This sharp rise has no history. The current market prices are now higher than the prices of March 1 +9 points VS -4 points over the same period in 2019!

Phase 3: Second Containment

A fall in prices is felt from the beginning of September. Often due to the renewal of the devices at the arrival of the back to school as well as the various releases of new models (iPhone SE, Samsung Galaxy Z Fold 2, iPhone 12, 12 Pro, 12 Pro Max and Mini).

The trend is down until the end of October, as soon as the second lockdown is announced. However, this fall is much less brutal than the first, as plant activities were less impacted than in March and April.

The holidays are coming and the end of the second lockdown has just been announced. What about prices in December and early 2021. Will we see price stabilization? The next update.

MAJ 11 juin 2020

And in June ?

As of 1 June, the stock of reconditioned products on the market continues to decline. Demand remains strong and the collection products from the recovery are not yet on the market. In these unprecedented times, we will not make predictions, just one certainty, the market will remain very volatile for several months.

Impact of Covid-19 on the prices of refurbished smartphones.

Base 100 as at 16 March 2020, prices recorded on the Dipli market on the top 5 products.

According to OFCE economists, 8 weeks of lockdown will have reduced France’s Gross Domestic Product by 32%. It is essentially a demand shock that affects the economy with a decline in consumption and investment. The offer is also impacted in certain sectors, such as industry.

The high-tech sector is particularly affected by the pandemic situation. China is the first country to have gone into lockdown, but it is also the largest producer of screens, batteries or sensors, to mention only 3 essential elements for the production of a smartphone.

Beyond production, it is also demand that is strongly impacted due to widespread containment. The new electronics market entered a dark period, with 275.4 million units shipped in the first quarter of 2020. Against 321.4 million on average for the first quarter of 2019.

What about the price impact of refurbished high-tech products ?

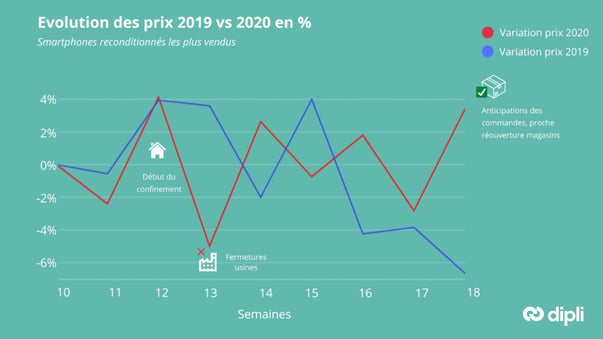

To answer this question, we compared the price evolution rate in 2019 vs 2020 in % and placed on the chart the events that impacted the sector.

Evolution of weekly prices recorded on top products sold on Dipli.

Paralyzed demand and supply

Following the announcement of the lockdown by the Government on Tuesday, March 17, our spending is sharply reducing and focusing on essential purchases. It is also the main driver of growth in France. Figures for the first quarter of INSEE indicate an increase in food spending of 7.8%.

-

Refurbished or new high-tech products are no longer so much purchased, they are no longer a priority at the moment. The demand is therefore paralyzed.

-

Remanufacturing plants have closed resulting in fewer offers and less flow to the market. Supply is shrinking significantly.

Low demand with reduced supply causes prices to fall between week 12 and 13 (the start of the lockdown).

Reorganization and adaptation

At the beginning of April (week 14), the factories begin to organize themselves little by little to maintain activity, although reduced, they allow to put new products on the market. Prices are picking up points and stabilizing.

Consumption resumes and needs adapt. High-tech devices are necessary for telework, to keep in touch with your surroundings or simply for leisure provided they are at reasonable prices. Refurbished offers are the answer to these new needs. Demand is increasing over the days and is accompanied by a supply that is slowly redeploying.

A market disrupted but not disrupted

Overall, the market for refurbished aircraft suffered a trough at the end of March, explained by a sharply reduced demand and supply. The lockdown had only a slight direct impact on the prices of refurbished smartphones (the time of a week).

There is a greater impact on the flows and quantities of products placed on the market and on the purchasing decisions of the latter.

As a result of the fall of the new market on the reconditioned market : very few new smartphone models were released during this period, usually resulting in a drop in prices on the old models sold on the reconditioned market. This is also a factor to consider.

The reconditioned market is a seasonal market. We observe peaks at certain times of the year (Christmas then January, the summer period June-July-August, the September-October). Coincidentally or not, March-April is a rather hollow period for the market. This could explain the fact that the market is not so out of sync.

Soon the reopening of stores

The deconfinement is close, the stores anticipate and stock to meet the demand of their customers. The factories are not completely open, they continue to adapt to maintain their activity. Prices are rising, demand is stronger but supply is growing slowly.

See you in a few weeks for a new post deconfinement analysis!

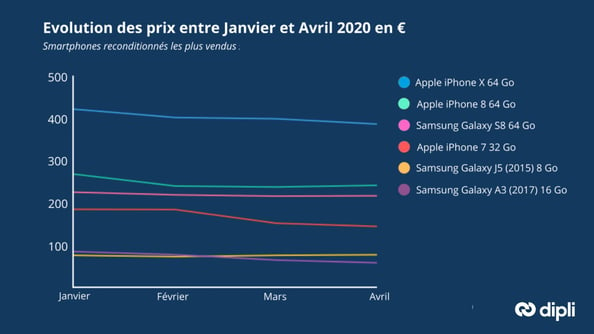

Appendix: evolution of prices in € of the top 6 refurbished smartphones sold on Dipli between January and April.

Dipli simplifies the second life of electronic products.

An all-in-one tool for distributors, leasing companies, telecom operators and companies to manage the entire value chain in one place.

The platform connects the electronics industry to secondary markets; simply and securely. Trade-in and return management, refurbishment, omni-channel purchasing and distribution: Dipli covers and simplifies all stages of the circular economy.

Comments (0)