Data infographic analysis: refurbished smartphones and trade-in in Europe

12/12/2025

0 comments

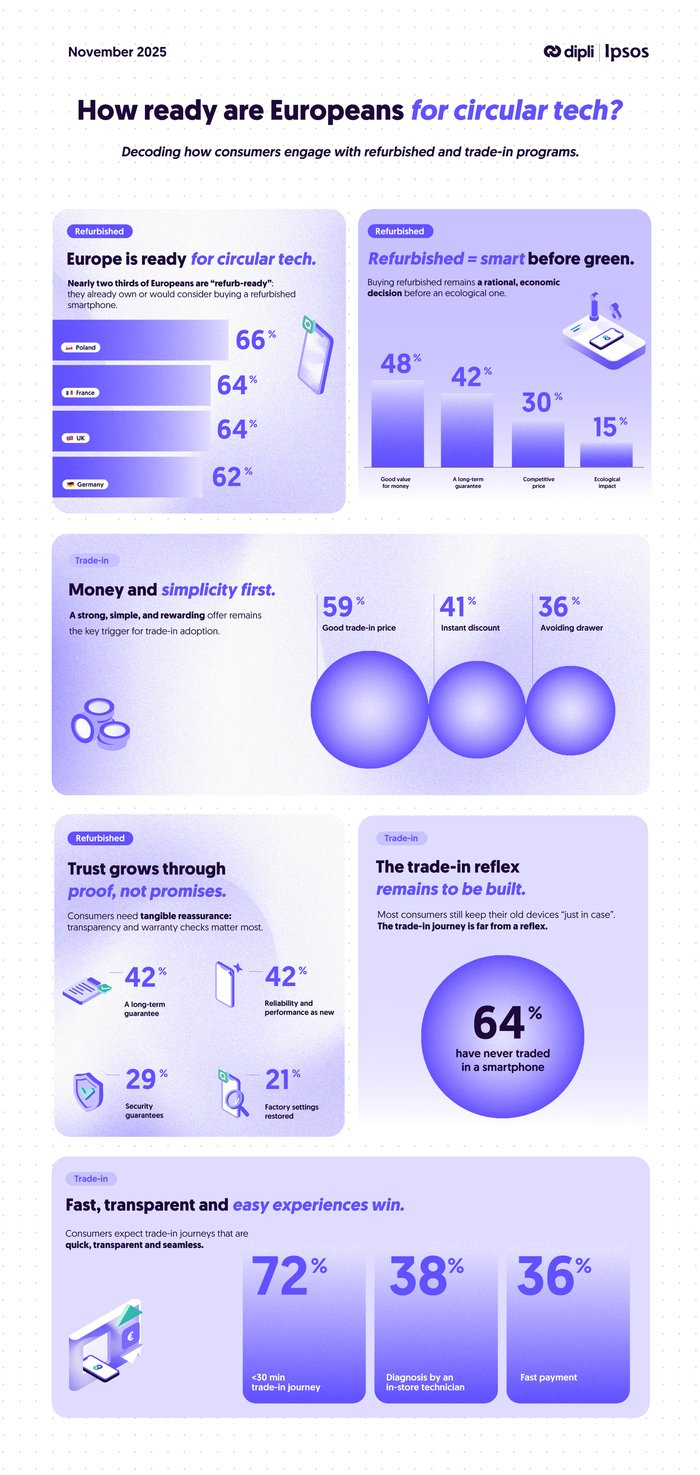

The Dipli x Ipsos 2025 study offers a strategic look at how European consumers are embracing circular tech through refurbished smartphones and trade-in programs. This year’s edition expands to four markets (France, Germany, Poland, and the UK) and introduces the Dipli Circular Index (DCI), a new benchmark for circular maturity.

Backed by stronger methodology and behavioral insights, the study identifies what drives or blocks adoption and trust. This is a must-have for tech professionals looking to expand circularity across Europe, with the right data-driven tool.

Want to receive the complete study? Contact us through this form down below:

Infographic: what does the data say about refurbished and trade-in across Europeans consumers?

Explore our exclusive infographic showcasing the key findings from the Dipli x Ipsos 2025 study. This visual summary highlights how European consumers interact with refurbished smartphones and engage in trade-in programs across four major markets: France, Germany, Poland and the UK.

From adoption trends to consumer expectations, the infographic offers a clear snapshot of the current state of circular tech in Europe. A must-see for tech professionals, retailers, and operators building effective refurbishment and device trade-in strategies in the electronic circular economy.

Trade-in adoption in Europe: consumers want better price, speed and simplicity

Although trade-in programs are a pillar of the circular economy, they’re still underused by consumers across Europe. For instance, the Dipli x Ipsos 2025 study reveals that 64% of consumers have never traded in a smartphone. Yet, the demand is there: when the offer is simple, fast, and financially attractive, users are much more likely to convert. These insights are crucial for those seeking to scale efficient smartphone trade-in programs and unlock the value of unused devices.

💡 A few trade-in key findings from the infographic:

- 59% say a good trade-in price is the main trigger to act.

- 42% are motivated by an instant discount at the point of sale.

- 72% expect the trade-in process to take less than 30 minutes.

- 38% value a diagnosis by an in-store technician.

Refurbished smartphones: strong interest but trust is still the missing link

The Dipli x Ipsos 2025 study confirms that refurbished smartphones are gaining traction across Europe with an average of over 6 in 10 consumers open to buying one in each analized country. But while interest is rising, trust remains a major hurdle. Consumers are looking for guarantees of reliability, performance, and security, which are essential to convert intention into action. The results highlight a clear opportunity for tech professionals to strengthen trust signals and grow the refurbished device market through quality and transparency.

💡 A few refurbished key findings from the infographic:

- 48% cite value for money as their top driver for purchase.

- Only 15% consider ecological impact a primary factor — confirming that price and trust outweigh sustainability in buying decisions.

- 42% demand performance and reliability equal to new.

- 29% look for strong security guarantees.

Dipli simplifies the second life of electronic products.

An all-in-one tool for distributors, leasing companies, telecom operators and companies to manage the entire value chain in one place.

The platform connects the electronics industry to secondary markets; simply and securely. Trade-in and return management, refurbishment, omni-channel purchasing and distribution: Dipli covers and simplifies all stages of the circular economy.

Comments (0)